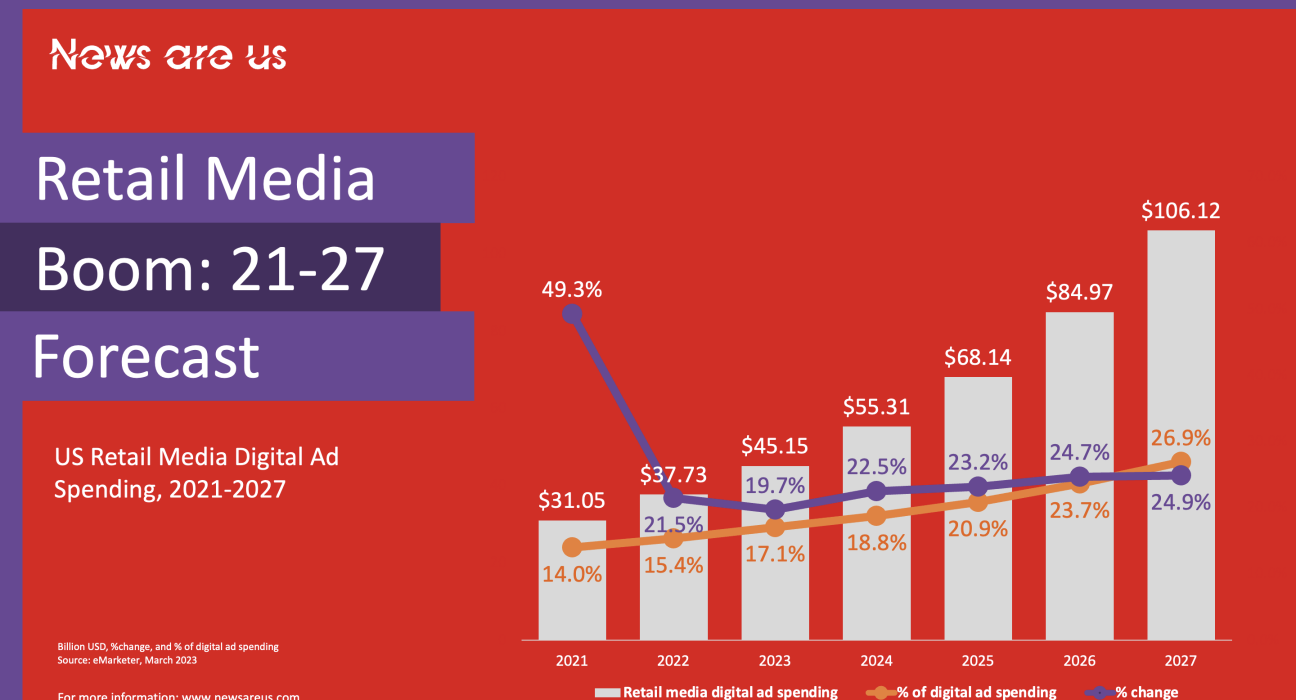

US retail media digital ad spending is projected to increase over 3-fold from $31.05 billion in 2021 to $106.12 billion by 2027. This represents a compound annual growth rate (CAGR) of 22.9% over the six-year period.

Not only is overall retail media ad spending growing rapidly, but it is taking up an increasing share of the total US digital ad market as well. In 2021, retail media represented 14% of all US digital ad dollars. By 2027, its share is forecasted to nearly double to 26.9% of the US digital ad market. This indicates that retail media is becoming an increasingly critical channel within brands’ overall digital marketing mix.

The data shows particularly high growth initially in 2021 versus the prior year (49.3%), likely due to the impact of the COVID-19 pandemic which accelerated digital adoption. Growth rates stabilize from 2022-2027 to between 19.7% to 24.9% annually. Despite the high baseline from initial pandemic impacts, retail media continues to significantly outpace overall US digital ad spending growth rates over the next several years.

The rapid increase in retail media adoption is driven by several key factors. Firstly, platforms like Amazon Advertising and Walmart Advertising introduced self-serve capabilities which makes retail media more accessible to brands of all sizes. Additionally, platforms provide robust closed-loop attribution tied to sales data which demonstrates retail media’s direct impact on product sales conversions. Relative to other digital channels, retail media also provides brands with discovery-based formats like product recommendations and category-specific placements which outperform contextually targeted ads. Lastly, as the platforms scale, prices remain competitive keeping the channel as a cost-efficient driver of site traffic and sales.

When analyzing the ad spending breakdown, Amazon likely retains dominance accounting for over 50% of total retail media in 2027, however, competitors like Instacart, Walmart, Target, and Kroger continue chipping away at share through enhancements of their owned & operated sites and apps. CPG, beauty, pharmacy, and DTC e-commerce brands lead retail media adoption across categories given the channel’s direct-to-purchasing capabilities and creative formats like shoppable influencer content that lend well to branded product discovery.

In summary, this chart highlights the exploding growth of retail media advertising in the US from 2021-2027 as spending increases 3x over the period to exceed $100 billion. The rapid adoption is expected to continue as retail media takes spend from traditional channels and distinctly connects ad exposure to online/in-store sales conversions at scale. The channel’s addressable formats, closed-loop data, and purchasing context will see retail media emerge as a dominant element in US digital ad strategies over the coming years.

Source: eMarketer, March 2023.

Editor's Choice

Retail Media

US

Retail Media Ad Spend Set to Triple by 2027

- by newsareus

- February 16, 2024